Simplifying Payment and Remittance Advice for Healthcare

In our daily lives, whether paying bills or transferring money, we expect transactions to be quick, clear, and accurate. Similarly, healthcare providers depend on efficient and transparent payment processing to maintain smooth operations.

The Payment and Remittance Advice Transaction, commonly known as EDI 835, plays a pivotal role in streamlining healthcare revenue cycles. This HIPAA-compliant electronic document provides detailed insights into payment decisions, including reimbursement amounts and denial reasons, ensuring smooth and accurate financial processes for healthcare organizations.

In this article, we’ll explore the EDI 835 in depth, its workflow, real-world applications, and how solutions like Zenbridge simplify these transactions to optimize efficiency and accuracy.

What is Payment and Remittance Advice?

Payment and Remittance Advice, also referred to as the EDI 835 transaction, is a standardized electronic document used to exchange payment details between payers (insurance companies) and healthcare providers. It replaces traditional paper-based remittance advice, offering a faster, more reliable, and secure method of communication.

Key Components of Payment and Remittance Advice:

- Payment Information: Details of reimbursed amounts.

- Denial or Adjustment Reasons: Clarity on rejected claims or payment modifications.

- Patient Financial Responsibility: Breakdown of co-pays, deductibles, and coinsurance.

By automating this process, the EDI 835 reduces errors, accelerates payment cycles, and enhances transparency in the healthcare revenue cycle.

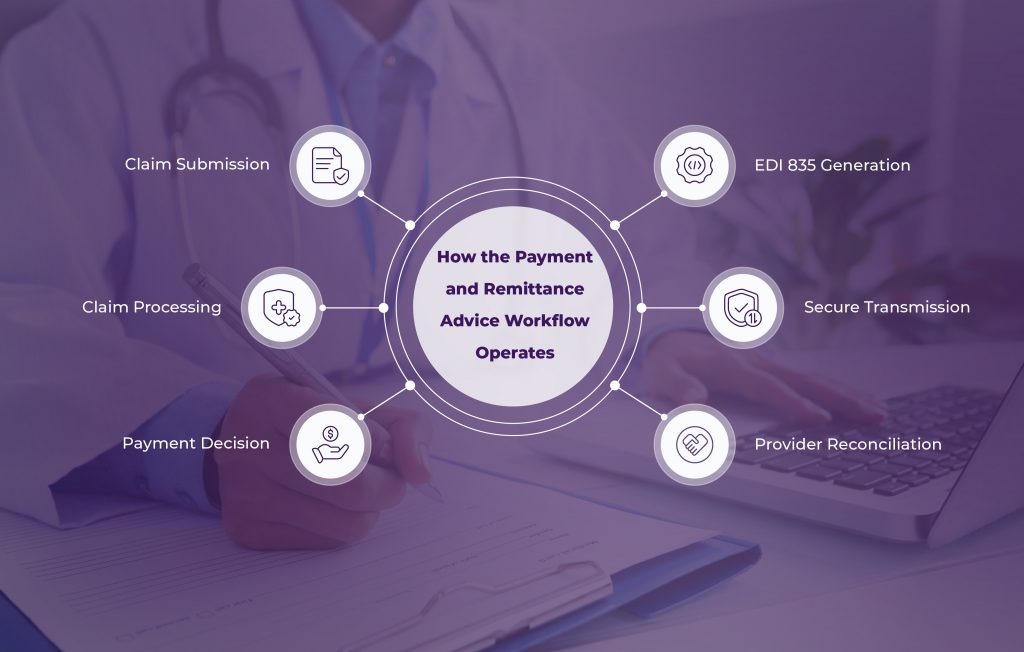

How the Payment and Remittance Advice Workflow Operates

The EDI 835 transaction integrates seamlessly into the healthcare payment ecosystem. Here’s a breakdown of its workflow:

- Claim Submission: Providers send insurance claims to payers using the EDI 837 transaction.

- Claim Processing: Payers review claims for accuracy, coverage, and validity.

- Payment Decision: Payers determine reimbursement amounts, adjustments, and patient obligations.

- EDI 835 Generation: A detailed electronic remittance advice file is generated.

- Secure Transmission: The file is transmitted to providers through an EDI VAN, API, or direct connections.

- Provider Reconciliation: Providers update their accounting systems, reconcile payments, and address denials or adjustments.

This workflow ensures faster processing, accurate payment tracking, and minimal disruptions in the revenue cycle.

Real-World Use Cases for Payment and Remittance Advice in Healthcare

The EDI 835 simplifies multiple critical healthcare processes. Here are some real-world examples of its impact:

1. Streamlined Payment Reconciliation

Providers can match reimbursement data with actual funds received, minimizing manual errors. This automated payment reconciliation boosts financial accuracy and simplifies account management.

2. Efficient Denial Management

The EDI 835 provides detailed reasons for denied or adjusted claims, enabling providers to address issues quickly and resubmit claims with accuracy. Improved denial management reduces revenue loss and accelerates resolution.

3. Transparent Patient Billing

With clear patient financial data (e.g., co-pays, deductibles), providers can generate transparent billing statements. This transparency minimizes disputes, fosters trust, and improves the overall patient experience.

4. Data-Driven Performance Analysis

Healthcare providers use remittance data to analyze payment trends, identify claim rejection patterns, and optimize billing practices. Regular performance reviews help enhance operational efficiency and improve revenue cycle performance.

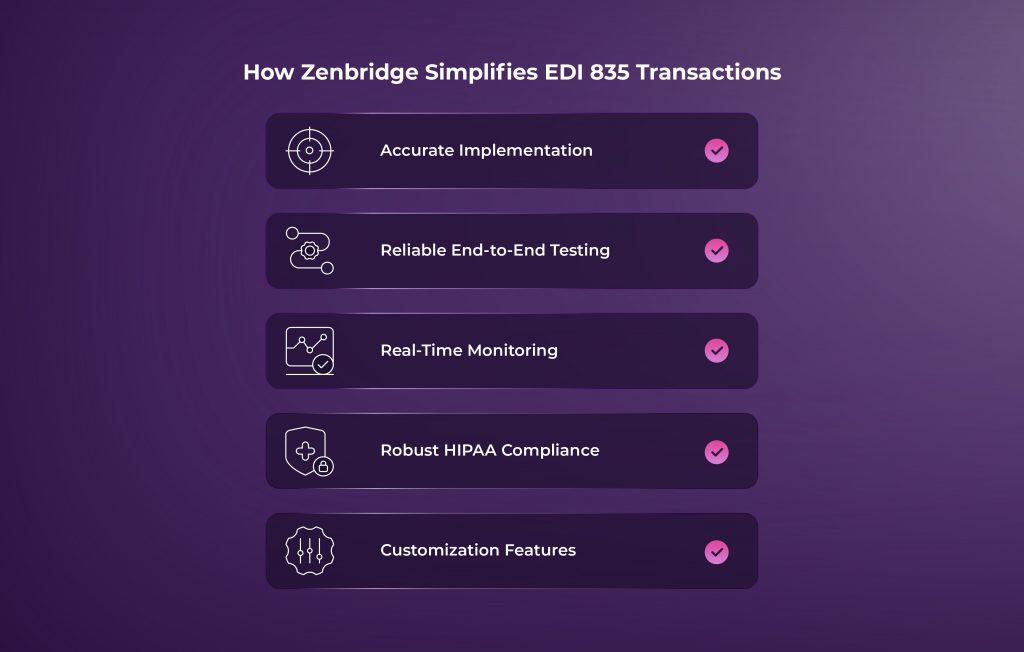

How Zenbridge Simplifies EDI 835 Transactions

Zenbridge offers a comprehensive suite of tools and services to make EDI 835 transactions seamless, error-free, and tailored to healthcare providers’ needs.

1. Accurate Implementation

- Custom Document Configuration: Aligns EDI 835 files with provider workflows.

- Industry-Standard Testing: Rigorous testing ensures compliance and accuracy.

2. Reliable End-to-End Testing

- Partner Integration: Validates file transmission and document parsing with all EDI partners.

- Proactive Error Detection: Identifies and resolves potential issues before deployment.

3. Real-Time Monitoring

- Dashboard Tracking: Comprehensive tracking of transaction errors for quick resolution.

- Functional Acknowledgments: Ensures successful file transmissions with instant error alerts.

4. Robust HIPAA Compliance

- Data Security: Advanced encryption safeguards patient data.

- Regulatory Adherence: Full compliance with HIPAA standards for secure and confidential data handling.

5. Customization Features

- Flexible File Formatting: Adapts to unique provider systems.

- Denial Insights Dashboards: Identifies trends for faster denial resolution.

- Automated Reconciliation: Simplifies payment matching for error-free results.

Why EDI 835 Matters in Healthcare Payment Processing?

The EDI 835 transaction is crucial for streamlining healthcare payment cycles, reducing errors, and enhancing financial transparency. Key benefits include:

- Faster Reimbursements: Enables quick turnaround for payments.

- Accurate Billing: Reduces administrative errors and improves efficiency.

- Financial Clarity: Provides clear data on payment decisions and patient responsibilities.

For healthcare providers, this ensures better revenue cycle management, improved cash flow, and enhanced patient satisfaction.

Conclusion

The EDI 835 is a cornerstone of modern healthcare financial systems. By automating payment and remittance advice, it helps providers streamline operations, reduce administrative burdens, and improve patient trust through financial transparency.

Transform Your EDI 835 Transactions with Zenbridge

Is your organization ready to take payment processing to the next level? At Zenbridge, we specialize in optimizing EDI 835 transactions, offering secure, efficient, and scalable solutions tailored to your unique needs. Schedule a demo with us today to discover how Zenbridge can revolutionize your payment workflows and simplify your revenue cycle management!